Homebuyer Resources

Download any of our free detailed guides now, or for quick answers on common topics of interest, browse our Homebuying FAQs below.

Quick Answers to Common Homebuying FAQs

FAQS: BUYER'S VS. SELLER'S MARKET

The real estate market constantly shifts, and knowing whether conditions favor buyers or sellers can help you make smarter, more confident decisions.

What is a buyer’s market?

A buyer’s market is when there are more homes for sale than there are people looking to purchase a home. With a greater selection of homes on the market and less competition, buyers typically have more time to shop, negotiate better terms, and may even see price reductions or other purchase incentives.

What is a seller’s market?

In a seller’s market, there are fewer homes available than there are buyers looking to purchase a home, creating a competitive environment where bidding wars and quick sales can be common. In this environment, sellers can often secure higher prices and more favorable contract terms.

How can you tell which market you’re in?

The market type you are in is usually reflected through the pace of sales, how many homes are available, and how close the sale price of a home was to its listing price. In hot markets, homes may sell within days, often well above their asking price. In slower markets, listings stay active longer and require more negotiation.

The market can shift quickly due to interest rate changes, job growth, seasonal trends, or shifts in consumer confidence. What was a seller’s market last year could easily become more balanced, or even buyer-friendly, within months.

While it's important to consider the market when making home purchase decisions, trying to time the market perfectly can be difficult. In most cases, personal factors—such as lifestyle changes, financial readiness, or long-term plans—will be larger drivers than short-term market fluctuations.

What should buyers do in a buyer's market?

With less competition, buyers can thoroughly research properties and make informed decisions without feeling pressured to make hasty offers. When homes are sitting on the market for longer, buyers have more leverage to negotiate a lower price or request seller concessions. For example, buyers can offer a lower price, include stronger contingencies, or negotiate for the seller to cover some closing costs or make repairs.

That being said, in a buyer's market, low-ball offers are common, so buyers beginning with lower offers should be ready to negotiate and potentially meet the seller halfway.

What should buyers do in a seller’s market?

Buyers should move quickly when a good listing appears, and make strong offers.

Buyers who are not paying in cash should come prepared with a strong, fully-underwritten mortgage pre-approval letter, and may even consider removing the financing contingency.

Waiving other contingencies and/or shortening contingency timelines will further strengthen your offer. It is also helpful if you can offer flexible closing terms to accommodate the seller's preferences (e.g., if the seller wants to close quickly or desires to stay in the home for a certain period of time).

It is wise to research and set up the third parties you will want to work with once your offer is accepted well in advance, so that you can offer the shortest contingency timelines possible. For example, it is helpful to connect with a home inspector you plan to use and ask them how much time they need to conduct an inspection. You will also want to ensure you understand how much time your lender requires to fund the loan if you are including a financing contingency.

FAQS: Mortgages and Financing

If you will be using a loan to purchase your home, one of the very first steps you should take is exploring mortgage lenders and obtaining a fully-underwritten mortgage pre-approval letter. This will help you solidify your budget, position yourself so you are prepared to make an offer once you find a home, and expedite the homebuying process.

What is a mortgage?

A mortgage is a loan offered by a bank or lender that lets you borrow money to purchase a home and repay over time with interest. Mortgages can take many forms, but one of the most popular options is a 30-year fixed rate mortgage. Many factors can affect the mortgage options available to you, including how much cash you will put towards a down payment, your personal finances (e.g., credit score, income, existing debt, employment history), and other factors like government policies, current interest rates, and what lender you are working with.

What types of loans are there?

Factors like where you are searching for a home and how long you plan to stay in your new home will help determine which loan type best suits you. Some options include:

- Fixed-rate mortgage: Sets an interest rate and monthly payment for the life of the loan, which is typically 15 or 30 years.

- Adjustable-rate mortgage (ARM): ARMs may offer interest rates that are lower than you could get with a fixed-rate mortgage for a chunk of the life of the loan, such as 5 or 10 years. However, after that point, your interest rates are subject to change approximately once per year based on market conditions.

By exploring multiple lenders and their available loans, you can determine which type of loan best suits your personal situation.

What is a down payment, and how much will it be?

Your lender will require you to pay a percentage of the home’s purchase price in cash, which is known as a “down payment.” The remainder can be paid using your loan.

Your down payment can vary substantially depending on your mortgage agreement. Typically, with a higher down payment, your monthly mortgage payment will be lower. Down payments are usually between 3 - 20% of the home's purchase price. You will also need to budget another 2 - 5% or so for closing costs.

In addition to the upfront costs, you will need to determine what kind of ongoing monthly payment you can afford. Online mortgage calculators and talking to potential lenders can help you with this.

What is a mortgage pre-approval letter?

A “mortgage pre-approval” is a document from your lender affirming their willingness to lend you money to purchase a home, up to a specific amount. It is based on the financial information you provide them, such as your pay stubs, list of debts and assets, and credit reports. In many areas with competitive markets, a seller will not consider your offer without a pre-approval letter, and in some cases may even require it before you can view the property (so that they know you are a serious buyer). Completing the mortgage pre-approval process will confirm the amount of loan you will be able to obtain and maximum home price you can afford.

What is a "fully-underwritten" pre-approval?

If you are looking to purchase a home in a competitive market, sellers expect a “fully underwritten” pre-approval, which is stronger than a standard pre-approval. Sellers will view an offer with a fully-underwritten pre-approval as better, since the chance of the buyer’s financing falling through – and thus the sale falling through – is extremely low compared to a buyer who only has a standard pre-approval.

- Standard Pre-Approval: Requires you to fill out the loan application, provide documentation to support all of the information in the application, and provide your consent for the lender to pull your credit report. The pre-approval is completed by a loan officer (LO), an LO assistant, or a loan processor, who may serve as your point of contact and administrate the loan paperwork. They will match your documentation to various line items in your application, pull your hard credit report, and in general look for any red flags. If everything matches and can be verified, you receive your pre-approval letter.

- Fully-Underwritten Pre-Approval: Goes one step further as it requires you to go through the full underwriting process. Your entire file will be reviewed by an actual underwriter, who is the person actually responsible for assessing the risk associated with a loan application and making the final approval or denial decision. This process requires more time and effort upfront (mostly on the lender’s part), but it ensures a faster and smoother loan finalization process once you are ready to make an offer. In competitive markets, many homebuyers seek a fully-underwritten pre-approval so that they can feel comfortable removing the financing contingency from their offer.

How do I shop for a mortgage?

Ask family and friends for referrals and/or search online to compare offers from various types of lenders. Lenders will typically advertise their current mortgage rates online, but these published rates come with a lot of fine print and vary significantly based on the borrower’s specific situation. You can usually get a quick, more personalized estimated rate by calling them and just providing some of your basic financial information verbally (e.g. income, existing debts, existing assets, estimated credit score, estimated budget). This can help you decide which lenders for which you want to take the next step of filling out an application.

Which lenders should I apply with?

You may want to apply and compare offers from at least a few of different types of lenders:

- Banks – you may want to ask your existing bank as well as compare offers from other large national banks (e.g. Bank of America) or small, local banks (e.g. Fremont Bank). These options are usually convenient and often offer competitive rates, but they can vary widely depending on the bank, so you should shop around.

- Credit Unions – smaller financial institutions which are not-for-profit, member-owned institutions (e.g. Redwood Credit Union). To obtain a loan from a credit union, you will likely have to become a member, which may require opening an account with them. Some credit unions have other membership requirements like living in a certain city, having a specific type of job, etc. Credit unions may offer more competitive rates and more personalized customer service compared to large banks, and may have less strict approval requirements.

- Mortgage lenders: Specialize specifically in mortgages (e.g. Freedom Mortgage), in contrast to banks and credit unions who offer a full range of retail banking products and services. They often offer a variety of mortgage options tailored to specific needs, though some of these might come with higher interest rates.

- Online Lenders – offer loans primarily or exclusively through online platforms, rather than through traditional brick-and-mortar branches (e.g. RocketMortgage, Loan Depot). They leverage technology to streamline the application and approval process, which can result in faster funding and potentially lower interest rates and fees for borrowers. However, they may offer less personalized customer service and be less reliable when it comes to closing on your loan.

Another option is to work with a mortgage broker, who is not a lender, but who instead will do the loan shopping for you. They act as the intermediary between the borrower and lenders, and typically have a large network of lenders they can utilize to find the most competitive offers for your specific financial situation. However, you will usually pay more in fees if you utilize a mortgage broker.

Will applying with lenders affect my credit score?

You should confirm with the lender before submitting your application whether or not the lender will need a soft or hard credit check. A soft credit check (or soft inquiry) is a review of your credit report that does not impact your credit score. Hard credit checks (or hard inquiries) can temporarily lower your credit score, but multiple inquiries within a short period (e.g., 14 - 45 days) may be treated as a single inquiry when calculating your score, so you would want to apply with all lenders you are considering within a short timeframe in order to minimize the impact on your credit score.

Sometimes, filling out the initial application will not involve a hard credit check if it only gets you a basic “pre-qualification” (which shows you a snapshot example of what the loan terms may look like), and is not yet an actual pre-approval. You should explicitly ask each lender if and when they will submit your credit check and whether it is a soft or hard credit check, and ask that they not conduct a hard credit check without your explicit consent so that you stay in control of the process.

How do I decide on a lender?

After applying, each lender will provide a Loan Estimate. This standardized form makes it easier to compare offers. Review your Loan Estimates carefully and discuss any questions with each lender. In addition to comparing the loan terms, you will want to factor in how quickly they can fund your loan once you make an offer (since this dictates the necessary length of your financing contingency, if you are including one), and their overall customer service. You should also confirm that once you are ready to make an offer on a home, the lender will re-issue your pre-approval letter at the exact amount you wish to offer (and how quickly they can do so), to avoid showing your hand to the seller if your pre-approval letter is for much higher than the amount you wish to offer.

What do I need to do after I've obtained my pre-approval letter?

A pre-approval is typically valid for 60-90 days, but you should confirm with your lender. If your home search takes longer, you may need to get re-approved.

In addition, once you’ve been pre-approved, you should avoid making any major financial decisions like changing your job or buying a car, and avoid opening or closing any credit lines, as these can impact your lender’s willingness to make your loan. If such a financial change is necessary, you should alert your lender as soon as possible so that they can re-confirm your pre-approval and there are no surprises that may impact your ability to obtain your loan at closing.

It is also a good idea to re-confirm how much time the lender needs following offer acceptance to be ready to close, so that you know the minimum number of days between sign and close to include in your offer.

FAQS: MORTGAGE INTEREST TAX DEDUCTION

For many homeowners, the mortgage interest deduction can offer meaningful tax savings. If you're navigating tax season or planning to buy a home, understanding how this deduction works can help you make smarter financial decisions. Here’s what you need to know:

What is the mortgage interest deduction?

The mortgage interest deduction allows you to subtract the interest paid on a qualifying home loan from your taxable income. This means you’re taxed on a smaller amount, which can lower your overall tax bill. It’s one of several financial advantages of owning a home, especially for those moving on from renting or weighing the costs and benefits of homeownership.

Who qualifies for this deduction?

To claim this deduction, you must itemize deductions on your tax return instead of taking the standard deduction. There is also a limit on how much interest you can deduct, which may differ between federal and state tax rules. Your accountant can help determine to what extent you will benefit from this deduction.

What types of loans are eligible?

The deduction applies to loans used to buy, build, or substantially improve a home. This includes first mortgages, refinances, and some home equity loans, as long as the funds go toward significant renovations or upgrades. Even loans related to construction or land may qualify under specific conditions, especially with permits or active building plans.

How much can I deduct?

Your deduction depends on your loan size and how much interest you paid during the year—figures you’ll find on Form 1098 from your lender. It's smart to check this early, especially if you refinanced your mortgage, paid in lump sums, or had a late-year closing. Understanding how this ties in with closing costs, insurance, and title fees can also help clarify your true homeownership costs.

Does everyone benefit from this deduction?

Unfortunately not. Since the standard deduction was nearly doubled in 2018, more than 90% of tax filers have a higher standard deduction than if they itemized, and this includes many homeowners. If your mortgage or other deductible expenses are low, the standard deduction may save you more—particularly for first-time buyers with modest mortgage payments or homeowners who are close to paying off their loans. But itemizing often pays off for households with larger loans, higher property taxes, or charitable contributions. Your home’s location and local tax rates can also influence the decision, so it’s worth reviewing each year.

Can I deduct mortgage interest on a second home?

Yes, mortgage interest on a second home can qualify for the deduction as long as the loan meets the same requirements that apply to your primary residence. The combined total of your mortgage debt for both homes generally must stay within the $750,000 cap. You’ll also need to itemize deductions and use the second home for personal purposes, not just as a rental.

What happens to my deduction if I sell or refinance my home?

If you sell your home, you can typically still deduct the mortgage interest paid up to the date of sale. If you refinance, your ability to deduct interest depends on how you use the new loan—interest is still deductible if the refinance is used to substantially improve the home or pay off original mortgage debt. However, if you take cash out and use it for unrelated expenses, that portion of interest will not be deductible as mortgage interest. Review your new loan terms carefully and keep your Form 1098 from both lenders.

FAQS: PROPERTY TAXES

Wherever you buy a home in the United States, property taxes are a reality of homeownership.

What are property taxes?

Property taxes are charges on your land and property, based on the value of your property, levied by your local government. The revenue generated is often used to fund community needs such as schools, police and fire departments, and road maintenance. Some states also tax personal property, such as cars and boats.

Can I know the property tax on a home before I purchase it?

Real estate listings typically include information on a property’s annual taxes. You can also ask the seller directly about their latest tax bill and when the property was last reassessed. Depending on the location, the assessed value—which is different from and generally less than the market value—of the property may increase based on the amount you pay for it.

How are property taxes calculated?

Tax rates vary widely depending on where you live. The most common method for calculating property taxes is by multiplying the assessed value your local government assigns to your property, minus any tax reductions, by the local tax rate. The assessed value is usually calculated as a percentage of the property’s market value. It reflects the overall quality and condition of the property, comparable homes in the area, and market conditions, among other factors.

The other component of the equation is the tax rate, often called the millage (“mill”) rate, equaling the property tax you owe for every $1,000 of your property’s value. For example, if the mill rate is $0.005, your home’s assessed value is $200,000, and you are ineligible for tax reductions, the following calculation would apply: ($200,000 in assessed value - $0 in tax reductions) x $0.005 mill rate = $1,000 property tax.

Are there property tax exemptions?

Certain homeowners may qualify for tax exemption programs which can lower, or even eliminate, their property tax bill. Senior citizens, veterans, disabled persons, and surviving spouses are some of the homeowner groups that may be eligible. Additionally, most states offer a homestead tax exemption for individuals’ primary residences. Programs and eligibility criteria vary by state, so consult a tax expert to determine which programs may apply.

How do I pay my property taxes?

The most common method for paying property taxes is through an escrow account, where a portion of your monthly mortgage payment is held and automatically paid towards your tax bill when it is due. You may choose to pay your taxes on your own, although in some cases your lender may require you to use an escrow account to ensure payments are made on time.

How often are properties reassessed?

Properties are generally reassessed annually to ensure any new community upgrades, such as the construction of a new school, and/or house upgrades, such as finishing a basement, are factored into the assessed value of your residence.

Can I challenge my property tax rate?

If you feel your property taxes are unfair—meaning you believe your house is not actually worth as much as it was assessed for—you can appeal the assessment and request a second evaluation of the property. There is typically a short window of time for submitting an appeal, so be sure to closely follow your local municipality’s instructions and timeline.

What are transfer taxes?

Separate from your annual property tax, transfer taxes are a one-time fee charged when the title of a property changes hands between the seller and buyer. Transfer taxes are an important consideration and can affect the overall cost of buying or selling property. The rates vary by location, and either the buyer or seller can pay the tax, depending on local laws, so be sure to work with your agent and legal counsel in negotiating the terms in your purchase agreement.

FAQS: SELLER DISCLOSURES

When selling a home, sellers must disclose certain characteristics of the property to potential buyers.

What are seller disclosures?

Seller disclosures refers to a document a seller is legally required to provide a buyer, disclosing certain "material defects" (elements of a home that may negatively impact its value) of which the seller is aware. Though what specifically must be disclosed is dictated by state and local law, sellers are typically required to list any completed repairs, information about natural hazards, property defects, missing essentials, land-use limitations, HOA guidance, deaths on the property, and any other conditions that might negatively impact the property’s value. Buyers should review the seller disclosures in full as they contain valuable information about the property, its history and condition.

Why are seller disclosures important?

Seller disclosures are important because they help protect both the buyer and the seller. The disclosures allow buyers to choose whether they want to make an offer on the house based on what the seller is disclosing about the property, or can influence the offer amount. For sellers, the disclosure can potentially help avoid future lawsuits against the seller for undisclosed issues.

How do I get the seller disclosures?

California Civil Code §1102 provides for a standard form for sellers to provide buyers the seller disclosures, called a Transfer Disclosure Statement (TDS).

In California, the TDS must be provided to the buyer "as soon as practicable" before the transfer of title, typically during the offer and acceptance phase. If the TDS is delivered after the buyer's offer is signed, the buyer has a 3 day period to rescind its offer based on the contents of the TDS.

What happens if a material defect about a property is not disclosed?

If a seller knowingly withholds information regarding a required seller disclosure, there may be legal consequences. A buyer could cancel the sale, or the seller could be legally liable.

FAQS: "EARNEST MONEY" deposit and Escrow

Buyers typically include as part of their offer an "earnest money" deposit, to be paid following acceptance of their offer by the seller.

What is an “earnest money” deposit?

Also known as a “good faith deposit,” an earnest money deposit is paid by a homebuyer to show their interest is legitimate and they intend to close on a home. This may be a percentage of the purchase price (e.g. 3%) or a set amount. The larger your earnest money deposit, the more attractive your offer, since the seller knows you are serious about the purchase.

To protect you, the earnest money deposit will be held securely by an escrow agent in an escrow account until closing (or if there any disputes, until those disputes are resolved).

Note that the earnest money deposit is NOT the same as your down payment, which is the amount of money your lender requires you to put toward the home’s purchase price (e.g. 20%). However, the earnest money is treated as an advance payment toward the home purchase, reducing the amount the buyer needs to pay at closing for the down payment or other closing costs.

Is an earnest money deposit required?

There are no laws requiring an earnest money deposit to be attached to a home offer. However, it is a common practice, especially in competitive markets (including California) and/or when a buyer’s down payment is less than 20% of the purchase value.

How much earnest money should I offer?

Earnest money deposits can be any amount, but across the country, typically range from 1% to 10% of the home’s purchase price. The size of your deposit may depend on several factors, including the competitiveness of the market, your down payment amount, whether you include contingencies in your offer, and the seller’s preferences.

In California, the deposit is usually 3% (or sometimes less), because California law caps liquidated damages for residential property sales at 3% of the purchase price. This means that if the buyer defaults on the contract and the deposit is 3% or less, the seller can keep it. However, if it exceeds 3%, the seller may have to refund the excess to the buyer, unless they can demonstrate that their actual damages exceed that amount.

What happens to the earnest money deposit after I pay it?

If the terms of the contract are followed and the transaction closes, the earnest money is treated as an advance payment toward the home purchase, reducing the amount the buyer needs to pay at closing for the down payment or other closing costs.

If the seller stops the sale, the deposit is returned to the buyer. Additionally, if contingencies included in the purchase contract—such as a home inspection, appraisal, or financing, are unable to be resolved—then the money gets refunded to the buyer.

However, if the buyer interrupts the sale for other reasons, the seller may get to keep the money. For example, if a buyer waives contingencies prematurely, fails to meet set deadlines, or gets cold feet and abandons the transaction (among other things), this could result in the loss of their deposit.

What is escrow?

Escrow is a financial agreement in which a neutral third party - called an escrow agent - controls payments between the buyer and seller, only releasing the funds involved when all the terms of the contract are met. It serves as a secure place to hold buyer's earnest money deposit while the buyer finalizes its loan, conducts home inspections, obtains homeowners insurance, etc. It will also hold the title to the property and other legal documents evidencing ownership of the property, and ensure there is simultaneous release of ownership of the property to the buyer and the purchase price to the seller.

Escrow protects both the buyer and seller by ensuring that neither party is at risk of losing money or property until all agreed-upon conditions are satisfied.

What is an escrow agent?

An escrow agent is a neutral third party who will hold your earnest money deposit and release it to the seller, or back to you, according to the terms negotiated in the purchase contract. They will also generally handle the closing logistics of the transaction, including the additional payments to be made to the seller and other third parties involved in the transaction at closing, and the transfer of the property ownership documents to the buyer.

In California, it is common for the title company to also serve as the escrow agent, rather than engaging a separate company as the escrow agent. Your lender will typically have a recommended escrow agent (and title agent) that they often work with.

FAQS: Steps Between Signing and Closing on a Home

Once you sign a purchase agreement on your new home, there are certain steps to complete before you can finalize—or “close”—the transaction. WiseBuy provides a simple checklist so you can easily manage these administrative parts of the homebuying process yourself. And if you decide you want additional support during the closing process, you can elect to pay for it on an hourly basis, so that you stay in control and pay only for what you need.

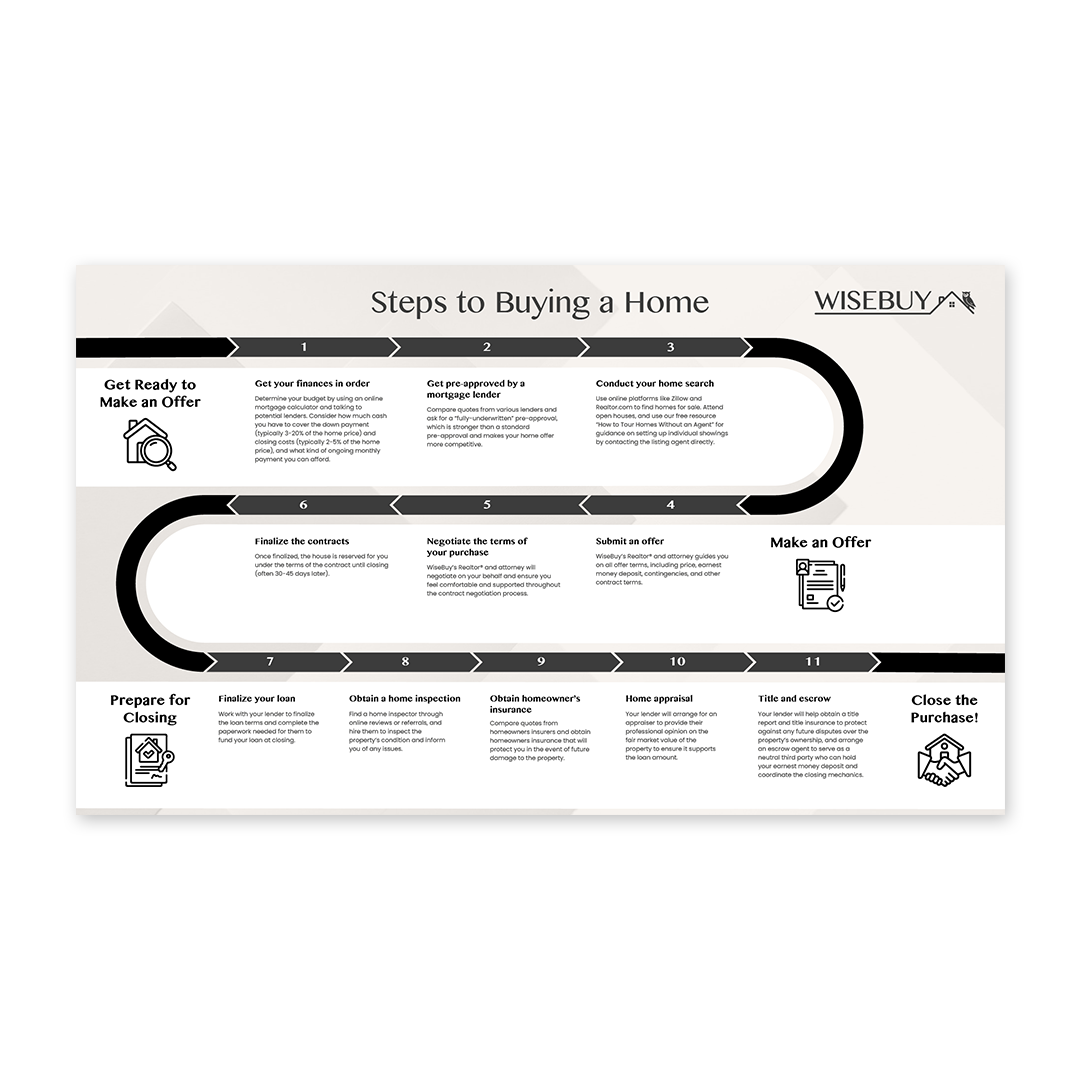

What happens after I make an offer?

Once you have made an offer, the seller may accept, reject, or counter your offer with different terms. If accepted, you will typically pay an "earnest money" deposit (e.g., 3% of the home price) within 3 business days of offer acceptance, and the house is reserved for you under the terms of the contract until closing (often 30-45 days later, but this all depends on the terms of your contract).

Your deposit will be held in escrow while the items that need to happen before closing are finalized. This often includes:

- Finalize your loan: work with your lender to finalize the loan terms and complete the paperwork needed for them to fund your loan at closing.

- Obtain a home inspection: find a home inspector through online reviews or referrals, and hire them to inspect the property’s condition and inform you of any issues.

- Obtain homeowner’s insurance: compare quotes from homeowner’s insurers and obtain homeowner’s insurance that will protect you in the event of future damage to the property.

- Home appraisal: your lender will arrange for an appraiser to provide their professional opinion on the fair market value of the property to ensure it supports the loan amount.

- Title and escrow: your lender will help obtain a title report and title insurance to protect against any future disputes over the property’s ownership, and arrange an escrow agent to serve as a neutral third party who can hold your earnest money deposit and coordinate the closing mechanics.

WiseBuy's free Homebuyer Resources and easy checklist help you manage these tasks independently. Plus, if you decide you want additional support during the closing process, you can elect to pay for it on an hourly basis, so that you stay in control and pay only for what you need.

How long does it take to get to closing?

The steps between signing and closing may take several weeks or more depending on your situation. 21-45 days is common. Usually, the more quickly you can close, the more attractive your offer is to the seller, so in competitive markets, this period may be even shorter.

Each part of the process operates on its own independent timeline, so the length of the process is impacted by many factors. You can speed it up by ensuring you have obtained a strong, fully-underwritten mortgage pre-approval letter in advance from a trustworhty lender, pre-arranging the other third party contacts you will need (e.g. home inspectors, home insurers), and scheduling appointments expeditiously (e.g. the home inspection).

What happens at closing?

You should expect to sign documents, exchange keys, obtain property ownership documents, and wire the additional amount you owe on the purchase price. The additional amount you owe is calculated by your escrow agent based on your down payment, credits, and other fees for things like the inspection, loan processing, or costs related to purchased insurance policies. The documents will need to be notarized, but your lender will often arrange a mobile notary to come to you to get the required documents signed.

FAQS: HOME INSPECTIONS

Between signing and close, you will likely want to hire a home inspector to examine the condition of the property and identify any issues.

What is a home inspection?

A home inspection is an assessment of a home’s condition in which an inspector identifies potential problems in a home’s structure, exterior, roof, plumbing, electrical systems, heating and air conditioning, interiors, ventilation/insulation, and fireplaces. An inspection may also include tests for problems that can affect human health like mold, radon gas, lead paint, and asbestos. The inspector will provide a report outlining their findings, and depending on how the purchase contract was structured during the contract negotiation, you may be able to negotiate repairs or back out of the purchase if significant issues are found.

Are home inspections required?

No, but a buyer can choose to include an inspection as a contingency—a condition that must be met for the transaction to continue—in their purchase agreement. This is because inspections can help inform buyers and flag costly problems they may not notice until after move-in. However, some buyers may choose to waive home inspections as a tool to make their offers stand out in competitive markets. There are also options somewhere in between, such as only asking for a seller to make repairs for major issues found during an inspection.

While not required, some buyers include a home inspection as a contingency in their purchase agreement. An inspection protects you from costly problems you may not have noticed until after moving in. An inspector will look for potential problems throughout the interior and exterior of the home, which could include tests for radon, lead paint, and asbestos.

Who performs the home inspection?

Members of the American Society of Home Inspectors (ASHI) or the International Association of Certified Home Inspectors (InterNACHI) are trained and certified to perform the inspection. The cost will vary depending on a property’s size and how many additional tests are needed. An agent who is a REALTOR® can help you find a trustworthy inspector and determine the types of inspections to consider.

Who is responsible for inspection costs?

In some cases, sellers may choose to have an inspection before putting their home on the market to get more information about the condition upfront, giving them more control over repairs and preparing them for discussions with buyers.

Otherwise, buyers are typically responsible for the cost of the inspection. The home inspection typically costs $300-$600 (or more), depending on factors like property size, location, the inspector's expertise, property condition, demand, and urgency.

Sellers may offer to cover the cost of home repairs as a concession when marketing their property, or buyers could request the seller pay for inspections as part of the purchase agreement.

Can a buyer attend an inspection?

Yes, it can be very beneficial for a buyer to join the inspector as they do their work. For example, inspectors can show buyers where plumbing or electrical details are located and help them understand the scope of any potential or identified problem. You as the buyer are the home inspector’s client and can ask them questions in real-time and/or to walk you through the report, answer your follow-up questions and provide advice.

How long does the home inspection take?

The length of a home inspection will depend on factors like a home’s size and condition, but will typically last at least two to three hours.

What are some of the common issues found during home inspections?

Inspection reports educate buyers on the current conditions of systems and structures in a home, including recommendations on how to maintain a home and updates for future consideration. Inspectors may flag items that should be monitored or issues that have the potential to cause larger problems after move-in. These issues vary widely, but some common problems inspectors look for are structural or foundation problems, improper drainage that could damage the structure over time, faulty wiring that could disqualify a home from being insured, HVAC system issues, and safety issues such as tripping hazards or too few smoke alarms or carbon monoxide detectors.

What does it mean if a home is listed “as-is”?

A home being sold “as-is” or “in its present condition” means that the seller is not making any guarantees about the home’s condition and has decided they will not make repairs even if the buyer decides to get an inspection.

FAQS: Homeowners Insurance

Between signing and closing, you should obtain homeowners insurance to protect you in the event of future damage to the property.

What is homeowners insurance?

Homeowners insurance covers you for unexpected losses at your home or property. It can include provisions to repair or rebuild the property or other structures not attached to your house (e.g., fences or detached garages), replace assets within the home, cover legal and/or medical fees for accidents that happen to you or someone else on the property, or even pay for living expenses if a covered incident forces you to live elsewhere temporarily.

You should compare quotes from various home insurance companies, and the cost will vary significantly based on factors like property size, location, property condition, and the type of coverages you want. The cost of homeowner’s insurance may average around $1,350 per year, but there is significant variance based on the aforementioned factors.

What are perils, and which are covered?

“Peril” is an insurance term for a specific risk or reason for a loss. Your insurance will cover a loss only if it is caused by a peril that your policy covers. Policies can vary in which perils are covered, but the most common policy type, HO-3 or the “Special Form,” covers the home structure and personal belongings for disasters including fire, hail, lightning, freezing, theft, and vandalism. Most policies exclude floods and earthquakes.

Is homeowners insurance required?

If you are taking out a mortgage on your new home, your lender will require you to have a homeowners insurance policy for the duration of your mortgage. If your mortgage is paid off, or if you’ve paid for the home in cash, no laws require you to maintain insurance. However, having insurance is generally a good idea to ensure your assets are protected.

How much does homeowners insurance cost, and how do I pay it?

The cost of homeowners insurance depends on several factors, such as the house’s age, square footage, condition of the property, and location. You may have the option to pay your premium on a monthly, quarterly, or annual basis. Some lenders collect the insurance premium as part of your monthly mortgage payment, place it in an escrow account, and pay the insurer on your behalf.

How much will my insurer pay me?

In the event of a loss, there are two common types of reimbursement:

- Replacement cost value is the amount needed to buy a new, similar version of something you own. Insurers often cover this for your dwelling or property up to the limit of the insurance policy. If your home is insured for at least 80% of its replacement cost, and it gets damaged or destroyed, the insurer will reimburse you to have it repaired or replaced with similar materials of like kind and quality. Replacement cost is not the same as market value. For example, if you bought a $500,000 home five years ago, it is destroyed by a fire, and the actual cost today to restore it using similar materials is $375,000, you may be paid $300,000 after the deductible.

- Actual cash value is the current value of an item that loses value over time due to use and/or age (depreciation). The insurer pays out the cost to make repairs, minus any depreciation. This reimbursement type is most often used for replacing personal property but could also be applied to your dwelling if your property is significantly underinsured (less than 80% of replacement cost). In this case, if you bought a new table five years ago for $1,500, but due to normal wear and tear, it’s only worth $750 at the time of the covered incident, then your insurer will only pay out up to $750. You can, however, purchase replacement cost coverage for your personal property for an additional charge.

In addition, some insurers may offer add-on options to extend your dwelling coverage. For example, an extended replacement cost policy option gives extra coverage above the policy limit up to a set percentage. For example, if a home insured for $500,000 takes $750,000 to rebuild, an extended coverage policy at 20% would mean the insurer pays 120% ($600,000), or $100,000 above the limit.

Are homeowners insurance premiums tax deductible?

If the property in question is your main home, then your home insurance is generally not deductible. However, people who run a business from their home or those intending to rent out their property may be able to claim a deduction. Additionally, if you suffered a loss to your property caused by a presidentially declared disaster, you may be able to claim a casualty loss deduction. Discuss your unique needs with a tax professional.

FAQS: FLOOD INSURANCE

Flooding is the most common and costly natural disaster in the United States. Even a few inches of water can cause devastating damage. A licensed insurance agent can advise you on purchasing the right flood insurance to protect your assets. Here’s what you need to know:

Does my homeowners insurance cover flood damage?

Most homeowners insurance policies do not cover flood damage. While federal disaster assistance may be available to you when a flood occurs, it may be limited and is not guaranteed. The best way to ensure your assets are protected is to purchase flood insurance.

What is flood insurance?

Flood insurance covers a property for damage caused by flooding, including from incidents such as heavy or prolonged rain, melting snow, coastal storm surges, blocked storm drainage systems, or levee dam failure.

Is flood insurance required?

If you own a home or business in a “high-risk” flood area—any area with a 1% or higher chance of experiencing a flood each year, as defined by the Federal Emergency Management Agency (“FEMA”)—and have a federally backed mortgage, your lender will require you to have flood insurance. However, even where your lender does not require flood insurance, it does not mean your home is not at risk. According to FEMA, wherever it rains, it can flood. Consult an insurance agent for guidance on your specific circumstances.

How much does flood insurance cost?

The average cost of flood insurance is about $1,000 per year, according to FEMA. However, the cost can vary widely depending on many property-specific factors and the flood risk for each individual property. Your premium is also influenced by your deductible, or the portion of a claim that you must pay out of pocket.

What are my options for purchasing flood insurance?

Depending on where you live, you have two options:

- The National Flood Insurance Program (“NFIP”): The NFIP, managed by FEMA, offers flood insurance to property owners, renters, and businesses in participating communities. In return for access to flood insurance, participating communities agree to adopt and implement local floodplain management regulations that help protect lives and properties from flooding. For residential dwellings, NFIP policies offer coverage up to $250,000 for building repairs and up to $100,000 for personal property; non-residential properties are covered up to $500,000 for building repairs and $500,000 for damaged contents. Check your community's status on FEMA's website to determine if you are eligible. You can also get an NFIP rate quote online here.

- Private Insurance: Private flood insurance is provided by private companies rather than the federal government. Private insurers may charge comparable rates but offer more coverage than the NFIP, such as higher protection limits, policy enhancements, and payments for temporary living expenses if you are displaced. You can also supplement an NFIP policy with private insurance to extend your coverage further.

How long does it take for my policy to take effect?

Typically, there is a 30-day waiting period from the date of purchase until an NFIP policy goes into effect. There are exceptions if you purchase flood insurance in connection with a mortgage loan. Private flood insurance can vary.

FAQS: FIRE DAMAGE AND POLICY COVERAGE

Most

homeowners insurance policies cover fire and smoke damage, but some insurers may limit or not offer coverage if your risk is higher. You should contact an insurance agent or broker if you need separate fire insurance or have questions. Depending on where you live, your property may have varying degrees of risk of sustaining damage from a wildfire. Even if you aren’t in a high-risk area, you should fully understand your insurance coverage in the event of a fire. Here’s what you need to know:

Does my homeowners insurance cover wildfire damage?

Standard homeowners insurance typically covers the structure of your home, other structures on your property (like a detached garage or shed), and your personal belongings in the event of fire damage. This includes fires caused by candles, grease, electrical malfunctions (e.g., faulty wiring), wildfires, and lightning. However, a standard policy may not cover all fire damage, including damage caused by nuclear hazards, arson, poor maintenance, or regular wear and tear. Please contact your insurance agent if you have questions.

What if my policy doesn’t cover fire damage, or I cannot obtain coverage due to wildfires?

Similar to flood insurance, some private insurance companies may exclude or not provide insurance coverage in high-risk areas. It is important to shop around as some insurers may have more risk tolerance than others. For example, some insurers may be “non-admitted,” meaning it is not licensed by the state but can still legally provide coverage, including for “difference in conditions” to help address any coverage gaps. These “surplus lines” brokers specialize in risks that admitted carriers will not cover. However, while offering specialized coverage, these companies are subject to different regulations and don't participate in state insurance guaranty funds which protect against insolvency, so it’s important to ask questions and read the fine print.

To find a surplus lines broker, you may contact your state insurance department or your current insurance agent who may be able to refer you to a surplus lines broker who specializes in your specific needs.

What do I do if my home is deemed ineligible for fire damage coverage?

Some insurance companies may not cover damage caused by a fire if they consider your area to be too high-risk based on fire maps or risk scores. If your insurance company deems your home to be in a high-risk area, there are some things you can do to help manage the costs. This includes contacting an insurance professional to discuss your insurance cost and needs, gathering and comparing quotes from multiple insurers, including surplus lines, and obtaining a wildfire-prepared certification from an organization like the Institute for Building & Home Safety. You may also contact your state insurance commissioner who regulates the insurance companies in your state and may have additional information about fire insurance and risk maps.

What is a “FAIR” plan?

If fire insurance is not covered in your policy, you may consider purchasing a Fair Access to Insurance Requirements (“FAIR”) insurance policy. FAIR insurance plans are available in many states and are intended to protect high-risk homes that don’t qualify for certain types of insurance on the private market. While FAIR plans are typically more expensive and have limited protections compared to private insurance, they can serve as a crucial safety net for those who can't find insurance elsewhere.

FAQs: Appraisals

If you are financing your home purchase, as one of the steps between signing and closing, your lender will likely require a home appraiser to estimate the fair market value of the home.

What is an appraisal?

An appraisal is an opinion on a home’s market value that helps a lender ensure the purchase price is in line with the property value. Because your lender is providing a loan based on the expected value of the home, they want to ensure that the home is truly worth the amount you are paying for it. You will usually cover the cost of the appraisal, typically $300-$700 (or more), depending on factors like property size, location, the appraiser's expertise, property condition, demand, and urgency. The appraisal is conducted by a licensed or certified residential appraiser—an independent third party engaged by the lender to provide a professional judgment on the home’s value. Appraisers do not represent the buyer or seller; their sole duty is to come up with a fair and accurate valuation of the property.

Your purchase agreement might have a “contingency” on an appraisal—a condition that the market value and purchase price must align in order for the transaction to continue. A mismatch between a home’s appraised value and the purchase price could impact how much your lender allows you to borrow for your mortgage. Some lenders also have appraisers verify certain things like chipped paint or hand rails to ensure the home is safe. If you are not using a mortgage and are paying for a home “in cash”—money you currently have available—you still may make your offer contingent on an appraisal or do one independently, but it is not required.

Do I have to get an appraisal?

If you are taking out a mortgage on your new home, your lender will usually require you to get an appraisal to help establish the “loan-to-value (“LTV”) ratio,” which is the amount of your loan divided by the value of the home (as determined by the appraiser). Higher LTV ratios are riskier investments for the lender, so generally they look for LTV ratios of 80% or less. When making your offer, you can include an "appraisal contingency," which makes your offer conditioned on the property appraising at or above your offere price, to ensure that you aren't obligated to purchase the property if you cannot obtain the loan amount you expected due to the property appraising for lower than your offer price.

What does an appraiser look at?

Different appraisers may take different approaches. By referencing databases such as Multiple Listing Services—online platforms that compile home listings in a given market—appraisers can use recently sold properties that have similar characteristics, called “comparables,” to help come up with a reasonable value for your home. They will also look at the home’s condition, recent renovations or improvements, amenities, location, size, and other characteristics. Whatever method an appraiser uses, it must be independent, un-biased, and backed up by evidence.

Do appraisals take place in person?

An appraisal may include an in-person visit, but it is not always required. In some instances, hybrid and desktop appraisals are used where appraisers collect data remotely and speak with reliable third-party sources familiar with the property and surrounding area, such as current or former agents of the comparables being considered.

Can I communicate with the appraiser?

Yes. You and others involved in the

transaction are allowed to communicate with the appraiser and provide relevant property information. However, it is unethical and unlawful for anyone to intimidate, persuade, or bribe an appraiser to influence the valuation.

What happens if the appraised value is different from the purchase price?

A mismatch between a home’s appraised value and the purchase price can impact how much your lender allows you to borrow for your mortgage. If you included an appraisal contingency in your offer, you can attempt to renegotiate the purchase price with the seller or back out of your offer. If not, or if renegotiation of the purchase price fails and you still want to continue with your purchase, you can put more cash towards the purchase to make up the difference.

Will I receive a copy of the appraisal?

Yes. The Federal Equal Credit Opportunity Act requires lenders to automatically send you a free copy of home appraisals and all other written valuations on the property after they are completed. However, if you are granted an appraisal waiver by your lender, your lender is not required to send you a copy of the valuation report.

Can I request that an appraiser correct or update the appraisal?

If you believe the appraiser did not

consider important information about the property or available comparables, you can request a reconsideration of value (“ROV”) to ask that the appraiser reevaluate their analysis. Your lender will provide instructions on how to initiate an ROV. If you believe an appraiser has reached an inaccurate or biased decision, you can also file a report with your state and federal regulatory agencies using the Appraisal Subcommittee’s Appraisal Complaint National Hotline, or a local nonprofit fair housing organization.

FAQS: title insurance

Your lender will likely require a title report and title insurance to protect against any future disputes over the property’s ownership.

What is a title report?

The “title” to a property is the legal document providing ownership of the property. A title company will research a property’s history to ensure that the current seller has the legal right to sell you the property and that there are no other claims of ownership on the property that may pose an issue to your ownership (a “Title Search”). The title company will provide a “Title Report” outlining their findings. You are the title company’s client and can ask them to walk you through the report, answer your questions and provide advice.

What is title insurance?

In addition to the Title Report, your lender will require that you obtain “Title Insurance” in order to protect the lender against any losses that may arise from any future dispute over the property’s ownership, and you will likely want to obtain an owner’s policy which would protect you from the same. Title insurance typically costs 0.5%-1% of the home’s purchase price.

What does title insurance do?

Title insurance protects you from title-related issues including fraudulent claims on a home. One of its key protections is legal defense and loss coverage in the event that someone else claims to own your property because of a forged deed. It also protects your lender from defects in the title and ensures that the relevant purchase-related documents are valid and enforceable.

How do I find a title company to work with?

Your lender will typically have a recommended title company that they often work with. The title company will both issue the title report and provide title insurance. They are also called the "title agent." In California, it is common for the title agent to also serve as the escrow agent, rather than engaging a separate company as the escrow agent.

FAQS: HOMEOWNERS ASSOCIATIONS

In many housing markets, homeowners associations (HOAs) and other community associations can be a part of the homebuying (and owning) experience. Here’s what prospective buyers should know:

What are HOAs?

HOAs are organizations in residential communities that create and enforce rules for the properties and residents within their purview. HOAs can offer residents access to shared spaces and facilities, such as pools or clubhouses, and act as governing boards to help maintain these common areas. While HOAs are often associated with master-planned neighborhoods or gated communities of single-family homes, community associations can also include some shared properties with individual units such as townhouses and condos.

What are HOA fees and special assessments?

Homeowners in HOA communities are required to pay monthly fees (sometimes paid quarterly or annually). These may be used to cover the cost of landscaping, routine maintenance, neighborhood upkeep, shared amenities and common areas, and other operational expenses—including contributing to reserves to plan for and fund longer-term improvements or unplanned costs. HOAs may also collect special assessments for costs such as emergency maintenance needs or other major projects that reserves are unable to cover. As such, prospective homeowners should consider HOA costs when budgeting and preparing for homeownership.

Who runs HOAs?

Most HOAs are non-profits run by volunteer boards. Volunteering for the HOA in your neighborhood or building can provide better insight into how your HOA is run, allowing you to participate in important community decisions. HOAs have bylaws that guide how they function, including election rules, board member responsibilities, and meeting protocols.

What kinds of rules can HOAs enforce?

In addition to bylaws, HOAs have covenants, conditions, and restrictions (CC&Rs) and rules and regulations to help maintain uniformity and protect real estate prices. These can vary significantly, but may cover things such as landscaping, noise, parking, pets, home exteriors (including decorations), property modifications, and common area policies. That said, there are limitations to HOA rule enforcement; specifically, HOAs cannot enforce rules that conflict with local, state, or federal law.

Do condo associations differ from HOAs?

Condos, or condominiums, are a type of building or complex that can have HOAs or condo associations. A key difference between single-family homes in HOA communities and condos is the ownership structure. Typically, condo buyers purchase the units they live in and an ownership interest in the building’s common areas; in contrast, owners of individual properties in an HOA community own their property and lot, but common areas are owned by the HOA itself. However, exact ownership structures can vary.

What are co-ops?

Co-ops, or cooperative housing, are a type of shared ownership arrangement that only exists in certain states. Unlike condos, people living in a co-op own shares in the entire complex and have a proprietary lease on a specific apartment. Interested buyers must apply and be approved by the co-op board, which is made up of other residents.

What are the benefits and drawbacks of HOAs?

Many prospective buyers are drawn to the amenities, enhanced security measures, and maintenance support that HOAs can offer. However, the added costs of HOA fees and special assessments can be a financial burden for some buyers, and others may be concerned about potentially restrictive regulations. Your real estate agent can help you determine if an HOA community is right for you based on your needs and preferences.

FAQS: Real Estate Auctions

Buying a home at auction can be an exciting opportunity to get involved in real estate, but there are certain risks and rules to be aware of. Whether you’re a first-time buyer or an experienced investor, understanding how auctions work can help you bid confidently.

What is a real estate auction?

A real estate auction is a public sale where homes are sold to the highest bidder. Auctions can happen in-person or online.

Why would a home be sold at auction?

Homes often go to auction after bankruptcy or foreclosure, which occurs when a homeowner fails to maintain their mortgage payments. However, some sellers may opt into an auction as a way to sell properties quickly and reduce carrying costs.

What types of real estate auctions are there?

What types of real estate auctions are there?

- Absolute Auction: The property sells to the highest bidder, regardless of price.

- Reserve Auction: The seller sets a minimum price; if bids don’t meet it, the property doesn’t sell.

- Foreclosure Auction: Lenders or courts conduct this to recover unpaid mortgage loans.

- Online Auction: The process is entirely virtual, which offers broader access to potential buyers but requiring careful review of the property details and the terms of the auction.

What should I know before bidding?

Auctions may come with some risk, so keep in mind the following:

- Properties are sold “as-is”: A property sold “as-is” means that the seller is not making any guarantees about its condition and has decided they will not make repairs even if the buyer decides to get an inspection. During auctions, inspections are usually limited or not allowed at all. If possible, research title status, liens, and property condition beforehand. Renovation costs can sometimes be managed with the help of certain assistance programs.

- Financing may be restricted: Many auctions require proof of funds or mortgage pre-approval. An earnest money deposit—a percentage of the purchase price or a set amount paid by a buyer to show their interest is legitimate—is often needed.

- Expect additional costs: Bidding wars can drive prices higher than expected. Winning bidders also often pay a buyer’s premium (a percentage on top of the winning bid) along with closing costs and possibly back taxes or liens.

- Understand the rules: Some auctions require immediate payment, while others allow time to close. Be sure to read all auction terms carefully.

Are auctions only for investors?

No. While investors often frequent auctions, many first-time and traditional buyers also participate. However, auctions can move quickly and usually require upfront cash or financing preparation, which may not suit everyone’s timeline or budget.

Where can I find real estate auctions?

You can find these opportunities at local county courthouses, auction companies and websites, and government agencies (e.g., U.S. Department of Housing and Urban Development, Internal Revenue Service, Federal Deposit Insurance Corporation).